Do I need to be concerned about the rising inflation?

In this post we will answer: What is inflation? How does inflation affect the economy? How does inflation affect my investments and retirement plans?

If you’re in or close to retirement, or collecting social security, you need to be aware of this. Read on to understand why.

What is inflation?

We define inflation as the ongoing increase in the prices of goods and services over time. Inflation is often measured with the Consumer Price Index (CPI).

It’s important to note the key phrases “ongoing increases” and “over time.” Prices change all the time, for different reasons and in different ways.

For example, the increased cost for oranges can rise because of frost in Florida, but that’s not necessarily inflation. The prices will likely return to previous levels once supply and demand conditions change again.

Inflation generally causes prices to gradually rise over time. Meaning, your dollar won’t go as far this year as it did five years ago. You’ve probably noticed this at the grocery store or gas station.

Inflation happens for many reasons, one is the increase in the cost to make the goods or service. For example if labor costs increase, a restaurant has to pay a server more and so the cost will be passed along in the price of the food they’re serving to the consumer. If you rely on oil to manufacture a product and oil prices increase the price of the product you sell will increase as well.

How does the Federal Reserve address inflation?

The Federal Reserve System (Fed) was established by Congress over a century ago to serve as the U.S. central bank. The main goal of the Fed is to promote the stability of the financial system. The two main components are: price stability and maximum employment.

Currently the Fed maintains a target inflation rate of 2% per year. One way it does this is by influencing interest rates. As the economy starts to experience significant growth or overheat, the Fed may slowly increase interest rates to slow down the economy and the potential for high inflation levels.

Historically when the economy slows down, one of the key levers the Fed has is to lower interest rates to move the economy back toward maximum employment. Currently the Fed is keeping interest rates low to help spur the economy.

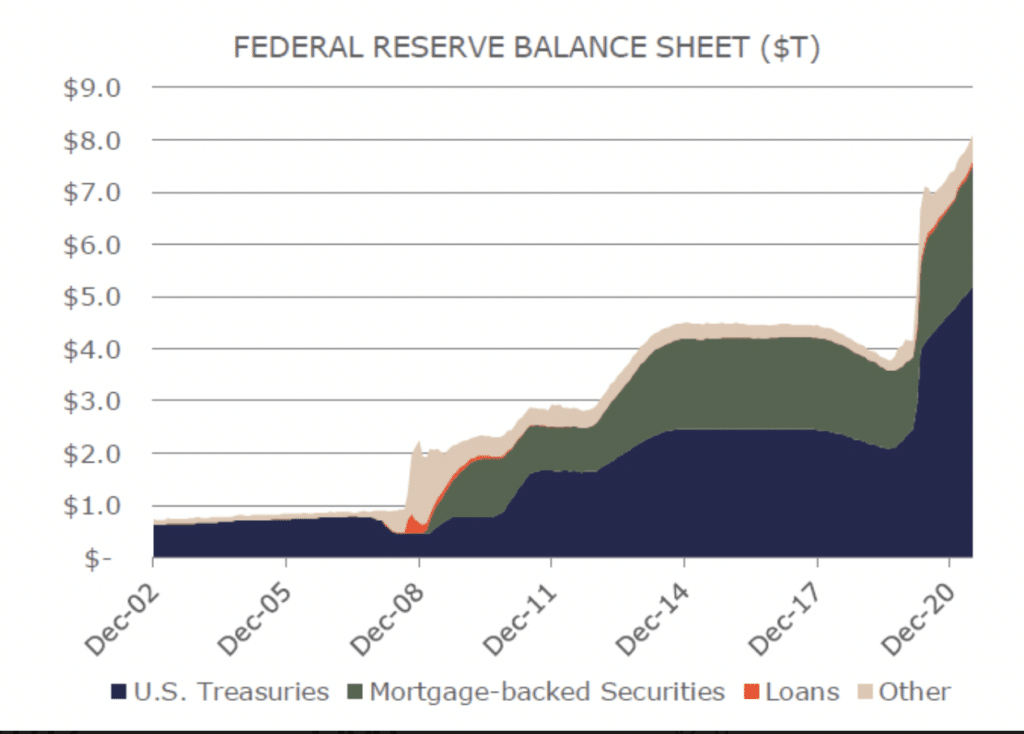

The risk is that the Fed keeps interest rates too high or too low for too long. The low rates in combination with the other accommodative Fed actions, like the amount of securities they have bought, is unprecedented.

What is the historic impact of inflation?

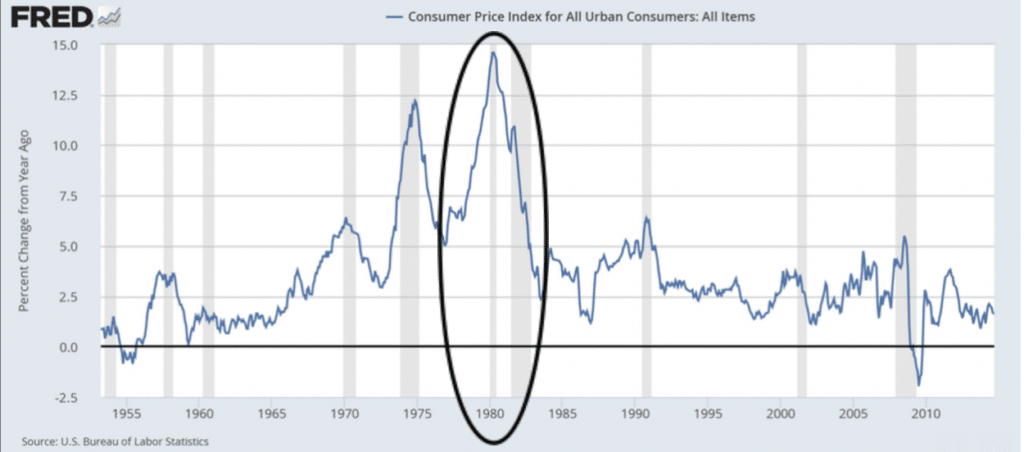

If you’re over 50 you may remember the last major period of elevated inflation in the mid 70’s through the early 80’s and what a huge problem it became.

The 1970s were bookended by oil shocks that brought soaring prices for gasoline. To level the skyrocketing inflation, Fed chairman Paul Volcker slammed the brakes on the economy by raising interest rates to an unheard of 20%. By 1983, inflation had retreated, but it was a painful correction for job loss and the inability to purchase houses and cars.

What’s happening with inflation today?

A recent Charles Schwab article asks, “Is 1970s-style inflation coming back?”

There are some similarities to today: pandemic relief payments have increased consumer spending.

The U.S. government printed a lot of money in 2020-2021 via stimulus checks, but so did the rest of the world in response to the pandemic. If we keep printing money, each dollar is worth less.

This might mean our currently low interest rates would need to rise to help offset potential skyrocketing inflation.

What we don’t know is, once inflation ramps up, how hard is it to slow down? Will it cause a recession?

How could inflation affect my investments?

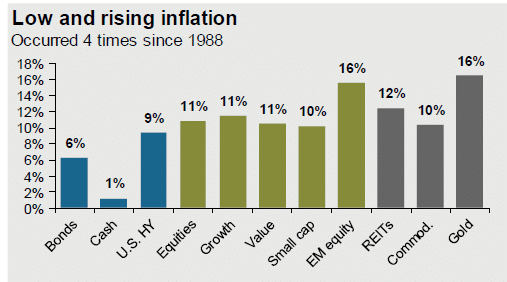

In a high inflation period, cash in a bank account is the most challenging place to hold your financial assets.

Over the last year the CPI increased by 5.4% and the money market funds made closer to zero. It may not appear that you have less money but that same amount of money will buy 5% less than a year ago.

Historically when inflation rates were on the rise people invested in real assets like commodities, gold or real estate. This has proven itself over the last year.

How could inflation impact my retirement plans?

Inflation disproportionately impacts people on a fixed income, which includes those in retirement. Your fixed income will buy 5% less than a year ago.

Inflation really is a form of a tax, as it affects the value of the dollar. If you’re planning to retire, inflation may affect when that is possible, since your money may not be worth as much or last as long.

Your retirement plans also depend on where your money is invested. If it’s in money market accounts, CDs, or a fixed annuity, your assets will not be adjusted based on inflation—meaning you’ll lose purchasing power.

What can I do to protect myself from inflation challenges?

Economist Milton Friedman famously said, “Inflation is always and everywhere a monetary phenomenon.” In other words, inflation is unpredictable.

That’s why Kroon & Mitchell advisors study the history and impact of inflation—as well as paying active attention to current events. If economic conditions are changing you need to adapt your portfolio to adjust for these changes.

Much of the way we’ll advise you depends on your life stage, your current circumstances, and how you’re investing today. Let’s start a conversation, at no cost to you, today. Contact us HERE.