Everything You Need to Know This Tax Season

The IRS has announced that they will begin accepting returns on January 28, 2019. The filing deadline is Monday, April 15, 2019. Any returns submitted to our office after April 8, 2019 may be extended.

The IRS will never call you first. Communications with the IRS are always initiated through the US Mail. You should be automatically suspicious of anyone claiming to be from the IRS or another tax agency over the phone,

e-mail or online. Never open an e-mail or click on any link in an e-mail claiming to be from the IRS, as these are a cybertheft attempt.

Tax Cuts and Jobs Act: The 2018 tax filing season brings with it many changes. The intention of the Tax Cuts and Jobs Act is to reduce and simplify Individual taxation reporting. There have been adjustments to Individual

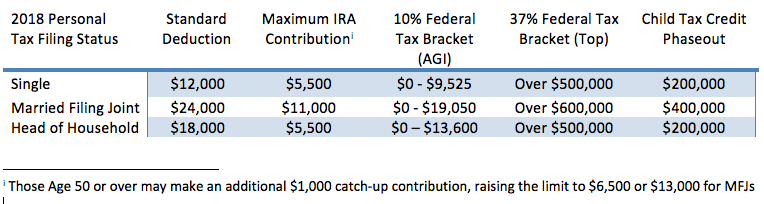

Income Tax Rates along with an increase in the Standard deduction and the elimination of Personal Exemptions (please see the abbreviated table below). The IRS has overhauled the Form 1040 Individual Income Tax Return adding additional reporting schedules. Those who itemize may only claim a $10,000 deduction for State & Local Taxes, which includes Income, Property and Sales Taxes. The Home Mortgage Interest deduction is limited to the first $750,000 of indebtedness used to buy, build or substantially improve your home. Home Equity Loan interest not used for these purposes is no longer deductible.

Itemized Deductions versus Standard Deduction: Due to the increase in the Standard Deduction for 2018, many Individual taxpayers will not itemize on their 2018 returns. Also, any deductions subject to the 2% floor are suspended through the Tax Cuts and Job Act and therefore no longer deductible on Form 2106. Examples include unreimbursed business expenses incurred by an employee for their employer.

Child Tax Credit: The Act increases the child tax credit from $1,000 to $2,000 subject to phase out at certain income thresholds. Eligibility for the credit has remained unchanged. The credit applies if all of the criteria are met including, the child is under than age 17 at the end of the tax year, the child is claimed as a dependent, and the child lives with the taxpayer for at least six months of the year. The Child tax credit is refundable up to $1,400, if the taxpayer does not owe any tax before claiming the credit.

Alimony: Effective for divorce or legal separations executed after December 31, 2018, income used for alimony payments and are no longer treated as income to the recipient or deductible to the payor. There is no change to the treatment of child support which means that there is no deduction or inclusion in income of child support payments made from one ex-spouse to another.

Moving Expenses: The deduction of moving expenses has been suspended for the filing years 2018 through 2025 other than for members of the Armed Forces. That Act also disallows the exclusion from gross income and wages for qualified moving expenses reimbursed to an employee.

The new Kiddie Tax: Unearned income of children in excess of $2,100 is now taxed at Trust & Estate tax rates.

2018 Business Tax Law Changes

C Corporation: Regular corporations are now taxed at a flat 21%. There are no more special rates that apply to personal service corporations. Corporations and partnerships with annual gross receipts of $25 million or less may now elect to use the cash method of accounting, even if they are required to maintain inventories.

Qualified Business Income Deduction (Code Section 199A): Effective beginning 2018 tax year ended Code Section 199A allows individuals as well as some trusts and estate to a deduction equal to the taxpayer’s “combined business income.” The deduction is limited to 20% of the excess of the taxpayer’s taxable income for the year over net capital gains for the year. A deduction of up to 20% of the qualified business income (QBI) from a business operated as a sole proprietorship, or through a partnership, S corporations, estate of trust. The pass through deduction is equal to 20% of the taxpayer’s QBI subject to agi phase out and other limitations.

Qualified Property: Bonus depreciation is back at 100% (with elections to apply only 50%) and now includes certain used property acquired for the first time by the taxpayer. Passenger automobile depreciation limits have also increased to $10,000 for the year the vehicle is placed in service, plus any allowed bonuses. The business asset deduction limitation under §179 is increased to $1 million with a phase-out increase to $2.5 million.

Meals and Entertainment: Entertainment expenses are no longer deductible. Certain business meals remain 50% deductible and the substantiation requirements have changed under the new law.

Like Kind Exchanges: Deferral of gain under §1031 is now allowed only for like-kind exchange of real property.

2018 Estates, Trusts and Savings Plans Changes

Exclusion Amounts Doubled: The lifetime estate and gift tax exemption amount in 2018 is $11,180,000. Annual gifts of a present interest up to $15,000 per donee may be made without any additional filing.

Conversions and Rollovers: Conversions from a Traditional to a Roth IRA can no longer be unwound. Employees who borrow from their 401(k) and separate from employment now have until the due date of filing their return (including extensions) to repay their loans and avoid having them taxed as distributions.

529 plans now include elementary and secondary schools: Qualified withdrawals from a 529 plan now include up to $10,000 in tuition per student for public, private or religious elementary or secondary schools.

Please use our Contact Page or call us at (616) 356-2002 to set up your appointment for the 2018 tax filing season.